We can extend our strategy and make it more profitable by incorporating short selling. Our annualized volatility will go up, but it will be interesting to see what happens to the annualized return. This is a very simple modification to make.

1-First we create a short selling vector:

shortVec=ifelse(((Cl(SPY)<Op(SPY))),-1,0) * ifelse(lag(Cl(SPY),1)<lag(Op(SPY),1),-1,0) * ifelse(lag(Cl(SPY),2)<lag(Op(SPY),2),-1,0) #This is saying that if the stock closes down for three consecutive days, short it.

2-As before, we lag it and get rid of the NAs:

shortVec=lag(binVec3Day,1)

shortVec[is.na(binVec3Day)]=0

3-Now we add the short-signal vector to the lagged and NA-removed long-signal vector we had before:

longShortVec=binVec3Day+shortVec

4-And as before, multiply the trading vector with the S&P return vector to get daily strategy returns, then run performance analytics.

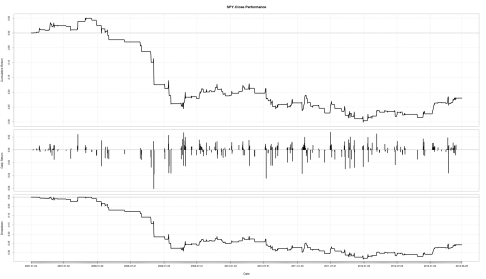

So with this modification, the annualized volatility rises to 9.40% approximately, and the annualized return falls to -7.10%. Not too good.

The strategy above, and all the subsequent modifications, were momentum based strategies. They rely on large, directed, short-term price movements to be profitable and don’t do too well when the price movements are small and directionless, but the market itself is following an overall trend. The strategies which do well in a trending market are called (!!!) trend strategies. We will look at one in the next post.

Another very important thing I ignored in computing the returns is adjustments for splits and dividends. This can be done using the adjusted price information provided for most equities, and that is what I will be using to calculate returns from now on. By using the adjusted price information however, we are not able to simulate when exactly we enter and exit the market (Open, Close), and that is a tradeoff we’ll have to make for greater convenience. However, I will still be using opening and closing price information to compute the trading signals.